Insurance coverage Resolution: An extensive Tutorial to Deciding on the Appropriate Coverage

All about Insurance Solution

On the subject of safeguarding your financial upcoming, certainly one of the most important decisions you may at any time make is choosing the appropriate insurance Answer. Whether you might be securing your property, health, car, as well as your life, an efficient coverage coverage can offer the reassurance you must confront lifetime’s uncertainties. But with a great number of options on the market, how Did you know which a single is the ideal suit to suit your needs? On this page, we’ll investigate the whole world of insurance methods, breaking down the different sorts of coverage, the key benefits of each, and how to select the greatest a single for your requirements.

On the subject of safeguarding your financial upcoming, certainly one of the most important decisions you may at any time make is choosing the appropriate insurance Answer. Whether you might be securing your property, health, car, as well as your life, an efficient coverage coverage can offer the reassurance you must confront lifetime’s uncertainties. But with a great number of options on the market, how Did you know which a single is the ideal suit to suit your needs? On this page, we’ll investigate the whole world of insurance methods, breaking down the different sorts of coverage, the key benefits of each, and how to select the greatest a single for your requirements.So, what precisely can be an insurance plan solution? In straightforward phrases, an insurance plan Remedy is any type of coverage that safeguards you economically against several challenges. These hazards could range from unexpected health concerns, car accidents, damage to house, or maybe the unlucky celebration of Demise. The best insurance Option can protect against fiscal spoil by aiding you deal with these prospective setbacks. It's actually not nearly covering expenses—It can be about furnishing a safety net that guarantees you and your family members can bounce back from daily life’s difficulties.

Enable’s start out by speaking about several of the most typical different types of coverage alternatives available today. Wellness insurance policy is amongst the initially that comes to mind. Definitely, wellness coverage is essential for guaranteeing you get the medical treatment you will need if you have to have it. Medical fees can promptly spiral uncontrolled, particularly in emergencies or for lengthy-term solutions. But with a good overall health insurance policy Option, you won’t have to experience these expenses by itself. Well being insurance plan usually handles hospital stays, medical professional visits, and in some cases even prescription drugs. The extent of protection may differ depending upon the approach you choose, so it’s essential to store around to find the best one particular for your Health care demands.

A different well-known insurance policies Option is car insurance plan. In the event you very own a vehicle, this is a ought to-have. Automobile insurance guards you with the monetary load that includes incidents, theft, or perhaps weather-related damage to your automobile. In lots of spots, having motor vehicle insurance policy isn’t just a good suggestion—it’s the legislation. Determined by your area and coverage, it might address anything from minimal fender benders to significant collisions, making sure that you choose to’re not still left spending out-of-pocket for pricey repairs. Vehicle insurance plan can also protect you from liability claims when you are located to become at fault in an accident, which happens to be vital for staying away from severe monetary consequences.

Then there’s home insurance policies, which is crucial for anyone who is a homeowner. Your home is probably the major investments you'll at any time make, so it only is smart to safeguard it with the appropriate insurance plan Option. Home insurance usually covers harm to your home due to organic disasters, hearth, theft, and vandalism. It may supply legal responsibility protection in case somebody will get wounded on your own property. For renters, renter’s insurance plan is the same Answer, guarding your belongings and featuring liability protection. Even though home coverage can’t prevent disasters from taking place, it can unquestionably assist you Get better a lot quicker in the event the unforeseen strikes.

Everyday living insurance policy is another essential style of coverage. It’s not a topic many of us like to consider, but lifetime insurance is A vital economical Device that can defend your family in case of your passing. A life insurance solution pays out a lump sum to your beneficiaries, aiding them address funeral charges, repay debts, or even preserve their common of living in your absence. There are a variety of types of lifetime insurance policy, like term lifestyle and entire life insurance policies, each presenting distinct Gains. When you've got dependents or any outstanding economical responsibilities, existence insurance policy could provide very important support to All those you leave at the rear of.

Even though these are definitely many of the most common insurance coverage solutions, there are lots of Many others to think about, such as incapacity insurance policy, business enterprise coverage, and travel insurance coverage. Incapacity insurance coverage provides revenue alternative when you’re struggling to function on account of sickness or harm. Organization insurance will help safeguard providers from risks like home problems, liability, and in many cases staff-similar concerns. Travel insurance plan is good for individuals who frequently journey, as it addresses excursion cancellations, dropped luggage, clinical emergencies overseas, plus much more.

In relation to selecting the ideal insurance policy Answer, There are some things you might want to contemplate. At first, consider your exclusive needs and situations. What exactly are you trying to shield? Do you have a loved ones that relies on the cash flow? Do you think you're a homeowner or renter? Comprehension your priorities will assist See details you to slender down the kinds of protection you'll need.

Upcoming, look at the prices connected to Each individual insurance plan Remedy. Though it’s tempting to opt for The most cost effective plan, it’s vital to make certain the coverage is adequate for your needs. Often spending a bit far more can provide greater defense Eventually, particularly when it addresses increased healthcare expenses or replaces lost money in the occasion of an accident.

It’s also essential to Evaluate insurance policy providers. Not all insurance policy firms provide the identical volume of customer care, protection choices, or rates. Make the effort to investigate different suppliers, read through opinions, and get estimates to discover the most effective offer. You don’t want to find yourself in a very circumstance in which your insurance company is tricky to reach or unwilling to pay a reputable assert.

8 Simple Techniques For Insurance Solution

The insurance policies marketplace has developed over time, and now a lot more than at any time, there are actually various digital equipment available to make it easier to make educated decisions. Many insurance plan vendors now offer you on line platforms that assist you to Review different policies, get quotations, and in some cases take care of your insurance coverage from the smartphone. These improvements make it easier than ever to locate the insurance policies Alternative that fits your daily life.It’s also a smart idea to evaluate your insurance solutions regularly. Daily life changes—whether it’s a fresh position, buying a home, having married, or possessing little ones—and your insurance policies needs may perhaps improve in addition. By staying on top of your coverage, you may make certain that you might be generally sufficiently secured and that you choose to’re not overpaying for unneeded coverage.

Now, Permit’s handle the significance of comprehension the good print. Insurance policies contracts could be challenging, full of legal jargon Which may be difficult to decipher. Nevertheless, it’s important to study through the terms and conditions meticulously prior to signing nearly anything. Be sure to have an understanding of what’s protected, what’s not, and what exclusions may well apply. The very last thing you need is to discover that the coverage doesn’t address a certain incident whenever you want it probably the most.

Together with the standard protection solutions, Additionally, there are specialised insurance policy options created for specialized niche requirements. One example is, pet insurance coverage may also help address veterinary expenditures, and flood insurance can defend your private home from water injury in areas prone to natural disasters. As Culture proceeds to face new hazards and troubles, insurance policies firms are innovating and offering progressively customized alternatives to satisfy precise calls for.

For many who get the job done in superior-threat professions or delight in adventurous hobbies, You will also find specialty insurance policies that can offer supplemental defense. Extraordinary sporting activities insurance coverage, for instance, is designed for people who have interaction in activities like skydiving or rock climbing, giving protection for accidents or accidents connected to these high-risk pursuits.

Insurance policy answers aren’t just for individuals; they can also be invaluable for organizations. No matter whether you’re a small startup or a significant Company, the ideal business insurance Resolution can guard your organization from the big range of risks, like residence harm, staff accidents, and in many cases authorized liabilities. The best organization protection can be certain that your organization can weather a storm and keep on working even in the face of unforeseen worries.

As we’ve viewed, the world of coverage is huge, and deciding on the best Remedy can experience overwhelming. But by knowledge your needs, executing extensive exploration, and frequently reviewing your guidelines, you are able to Make certain that you’re adequately protected. Regardless of whether you happen to be securing your health, house, car, or life, the correct insurance coverage Alternative is an essential Section of creating a steady economical upcoming.

The Best Guide To Insurance Solution

At the conclusion of the day, an insurance coverage Resolution isn't pretty much purchasing a plan—it’s about buying peace of mind. It’s about understanding that,

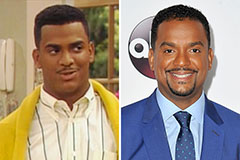

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!